A few insiders from Tesla Inc. have had a busy few days this week, including an investor close to Chief Executive Elon Musk and once again showing good timing in its trades.

That’s Elon Musk’s brother, Kimbal Musk, a Tesla TSLA,

board member and entrepreneur, who sold $ 25.56 million worth of shares in the open market this week with all trades above $ 850, according to a filing.

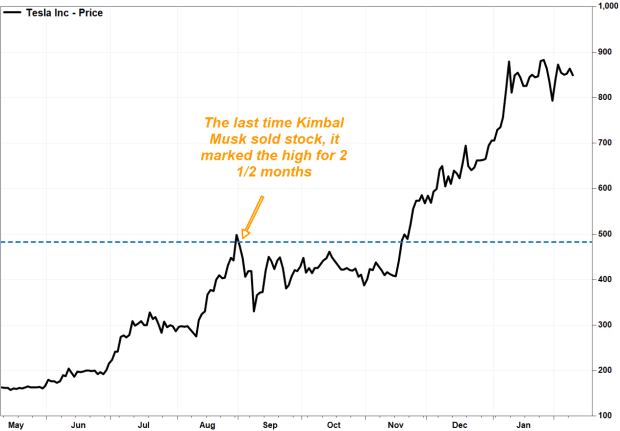

The last time Kimbal Musk sold stock of the electric vehicle manufacturer, he also exercised options to buy the same amount, just at a much lower price. At the time, Kimbal Musk sales seemed to be a stock high for over 2 1/2 months.

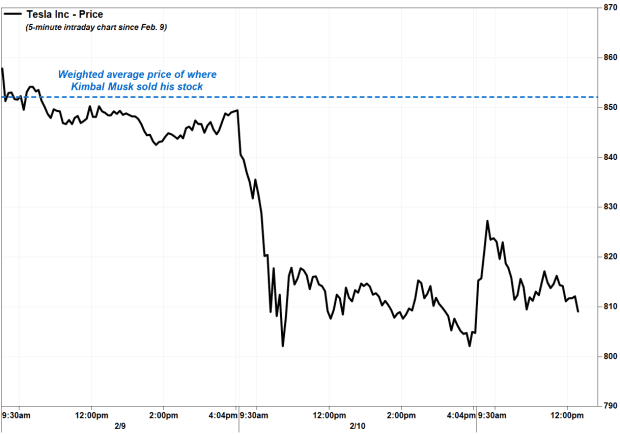

FactSet, MarketWatch

Kimbal Musk’s timing was also right this week. He sold his 30,000 shares on Feb. 9 in a series of trades at a weighted average price of $ 852,117, according to a MarketWatch analysis of SEC data. The stock opened at $ 855.12 that day and traded in an intraday range of $ 859.80 to $ 841.75 before closing at $ 849.46.

On Wednesday, the stock is TSLA,

fell 5.3%, with an intraday high of just $ 844.82. It was up 1% in Thursday afternoon trading, but at $ 812.41, it was still well below the level where Kimbal Musk sold his shares.

Here are Kimbal Musk’s trades:

• Sold: 7,971 shares for $ 850,277 (weighted average)

• Sold: 11,409 shares for $ 851,452

• Sold: 1,983 shares for $ 852,243

• Sold: 3,482 shares for $ 853,767

• Sold 3,415 shares for $ 854,805

• Sold: 1,140 shares for $ 855,927

• Sold: 600 shares for $ 856,676

FactSet, MarketWatch

After the sale, Kimbal Musk still owned 599,740 Tesla common stock, or about 0.06% of the shares outstanding. His remaining interest is worth approximately $ 487.2 million in stock at current prices.

Tesla’s stock is up 95% in the past three months, while the S&P 500 index SPX,

has gained 9.6%.

Vanguard increases the importance of becoming the second largest shareholder

While Kimbal sold, The Vanguard Group announced that it owned 57.81 million shares, or 6.1% of the shares outstanding, according to an SEC filing Wednesday.

That makes Vanguard now the second largest shareholder, after Elon Musk with about 18% and ahead of Capital Research & Management Co. by 5.5%, according to FactSet.

That means that Vanguard recently bought about 14.53 million Tesla shares, as the fund manager previously announced it owned 43.28 million shares, or 4.4% of the shares outstanding, on September 30. Prices paid for the shares were not disclosed.

Board member Antonio Gracias makes a pretty penny trading Tesla stock

In another SEC filing late on Wednesday, Tesla announced that private equity investor Antonio Gracias, a longtime Tesla board member and close to Elon Musk, had acquired a total of 150,747 shares earlier this week at a weighted average price of $ 58,149 by the company. exercise of derivative securities. .

On February 9, the same day that Kimbal Musk sold his shares, the filing shows that Gracias sold 150,747 shares in a series of transactions. He didn’t fare as well as Kimbal Musk, however, as he sold his stock at a weighted average price of $ 846,591.

Still, Gracias made $ 118.86 million on the transactions.

Here are Gracias’s trades:

• Acquired: 97,000 shares for $ 52.38

• Acquired: 53,747 shares at $ 68.56

• Sold: 1,930 shares for $ 842,596 (weighted average)

• Sold: 13,256 shares for $ 843.51

• Sold: 22,036 shares for $ 844,372

• Sold: 22,122 shares for $ 845,364

• Sold: 19,320 shares for $ 846,381

• Sold: 19,039 shares for $ 847.36

• Sold: 34,023 shares for $ 848,404

• Sold: 18,588 shares for $ 849.32

• Sold: 433 shares for $ 850,346

After the transaction, Gracias owned 2,545 Tesla common stock.

–Steve Goldstein contributed to this report.