Well-known TF Securities analyst Ming-Chi Kuo weighed in on “Apple Car” Monday and said Apple will work closely with Hyundai on a first model that could lead to new vehicles being built in partnership with General Motors and the European manufacturer PSA.

In a note to investors, Kuo confirmed recent reports of a potential partnership with Hyundai and said the company’s first “Apple Car” will be built on that company’s E-GMP electric vehicle platform. Hyundai Mobis takes the lead in designing and manufacturing parts, while Hyundai subsidiary Kia will handle production in the US

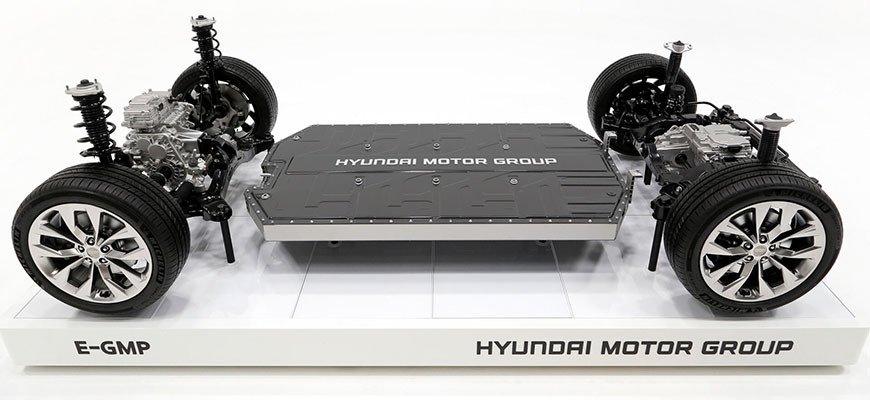

Unveiled in December, E-GMP is a special battery electric vehicle (BEV) platform consisting of up to two motors, five-link rear suspension, integrated driveshaft, battery cells, charging system and other parts of the rolling chassis. According to the company, the system has a maximum range of about 500 miles on a full charge and up to 80% charge in 18 minutes. Acceleration for a “high performance” configuration is quoted from 0-60mph in less than 3.5 seconds, with a maximum speed of 160mph.

Hyundai plans to use E-GMP as the basis for a variety of models debuting under both its flagship and Kia brands this year.

Like previous rumors, Kuo believes Apple is outsourcing parts production and assembly to established car manufacturers. EVs contain about 40 to 50 times more parts than a smartphone, the analyst said, suggesting Apple will have to rely on existing resources from carmakers if it hopes to make a functional car in time. The tech giant will not be able to build its own automotive supply chain – as it has done for devices like iPhone, iPad and Apple Watch – without incurring significant delays.

“Apple’s deep partnership with current automakers (Hyundai Group, GM and PSA) who have extensive development, manufacturing and qualification experience will significantly reduce Apple Car development time and deliver a time-to-market advantage” , Kuo writes. “We believe Apple will leverage current vehicle manufacturers’ resources and focus on self-driving hardware and software, semiconductors, battery-related technologies, form factor and internal space designs, innovative user experience and integration with Apple’s existing ecosystem.”

Given a longer development lead time, higher validation requirements, a more complex supply chain and “very different” sales and after-sales service, Kuo does not expect a so-called “Apple Car” to hit the road in 2025 at the earliest. That date is still considered aggressive for a tech company making its first foray into a new industry.

Apple is likely to market the vehicle as a “very luxury” model, or “significantly higher” than a standard electric vehicle.

If the first “Apple Car” proves successful, Apple could try regional partners in GM and PSA, the latter of which manufactures cars under various brands, including Peugeot, Citron and Opel.

Kuo throws cold water on the rumor that longtime manufacturing partner Hon Hai, entering the EV battle with its MIH platform, will land “Apple Car” assembly or housing orders. Pan-International, Eson, Long Time Tech and G-Tech are also unlikely to enter the supply chain, the analyst says.

Kuo’s predictions come amid a wave of “Apple Car” gossip. In early January, Hyundai confirmed – but then backed out – that it was under negotiation to produce Apple’s long-rumored auto project. Recently, a report from last week claimed that executives from the South Korean automaker are considering whether a partnership with the world’s largest technology company would be good for business.

“It’s not that working with Apple would always lead to great results,” said an unnamed manager Reuters last week. “Apple is in charge. They do their marketing, they do their products, they do their brand. Hyundai is also in charge. That doesn’t really work.”