Stock markets are recovering from Wall Street’s worst week since October 2020, making up for losses largely driven by a retail frenzy – but there are signs that more turbulent days are ahead.

Last week, investors based on the Reddit group WallStreetBets pushed up the prices of stocks in companies with high short positions, especially GameStop, forcing hedge funds to cover their shorts by selling large long-term bets. That, in turn, contributed to a sell-off that caused major indexes to move away.

But the retail rush is not over yet. WallStreetBets has a new focus: silver SI00,

Since Friday’s close, the precious metal is up more than 11% on Monday.

In our call of the dayIpek Ozkardeskaya, a senior analyst at Swissquote Bank, said silver’s soaring gains may be more rational than some investors expected from an Internet-based momentum game. But she also warned that Silver’s time in the sun can be short-lived.

In addition to causing pressure, the investment thesis endorsed by the WallStreetBets crowd is that silver is undervalued as it is widely used in high-tech applications such as solar panels, which are positioned for long-term growth.

Plus: Miners soar as silver futures jump to eight-year high on retail

Ozkardeskaya said there is some validity to be bullish about silver prices. The precious metal often trades in conjunction with gold, which saw a spectacular rise to record highs last year. Silver largely lagged behind.

The gold-silver ratio, which describes the relationship between the prices of the two metals, historically converges at almost 60 on average – meaning that the price of gold is GOLD,

is often about 60 times higher than silver.

Map of Marshall Gittler at BDSwiss.

Silver is currently trading at just over $ 29 an ounce, but Ozkardeskaya said it “could have consolidated well within the $ 30-32 band,” given that gold prices remained stable near $ 1,800 an ounce.

“That’s why the rise in silver doesn’t seem that far,” she said.

Also read: After 10 years of underperformance, raw materials will boom. Here’s how to play the Rally.

“So far it’s not exactly the GameStop anomaly, but it’s a hint that the retailers who have just discovered the power of their unit are looking for new targets – and apparently bigger ones,” added Swissquote Bank analyst. to.

“But for silver, the rally could be short-lived,” Ozkardeskaya said, noting that there is division between the posters on WallStreetBets, with some advising against betting on the rally. With the brief press on GameStop, there was almost unanimous support for that trade and overwhelming solidarity in the forum.

“An important thing to remember in this game is that if you lose the full support and momentum, it’s over,” said Ozkardeskaya. “The speculative stampede is a prosperous but dangerous game.”

The buzz

The trading frenzy is expected to continue at video games retailer GameStop GME,

and other heavily shorted WallStreetBets favorites like AMC AMC cinema chain,

software group BlackBerry BB,

and retailer Naked NAKD,

– all of which have jumped into premarket trading.

Trading app Robinhood has imposed buying limits on stocks in all of these companies, although otherwise it has shortened the list of restricted stocks.

Melvin Capital, one of the leading short position hedge funds targeted by WallStreetBets, lost 53% in January. It has now apparently “massively reduced” its portfolio.

On the US economic front, Markit’s manufacturing purchasing managers index for January is the first to come down at 9:45 a.m. East, followed by the ISM manufacturing PMI. Construction expenditures for December and the sale of motor vehicles for January are also due.

Exxon Mobil XOM chief executives,

and Chevron CVX,

discussed the merger of the two companies last year, The Wall Street Journal reported Sunday. Shares in both oil super majors are down nearly 2% in the premarket.

The Australian Prime Minister has suggested that software giant Microsoft’s MSFT,

Bing could replace Google’s search when it leaves the country. Google, owned by Alphabet GOOGL,

has threatened to make its search engine unavailable in Australia over a bill that would force technology companies to pay to distribute news content.

Outside the markets, the world is waking up to news of a coup in Myanmar, where the head of government Aung San Suu Kyi and other politicians have been detained. The military said it was taking control of the country for a year.

The markets

It looks like a positive day lies ahead as markets rethink after last week’s hectic pace. Stock market futures are higher YM00,

ES00,

NQ00,

poised for a strong opening with Dow futures pointing up more than 200 points after a poor last week. Asian markets recovered NIK,

HSI,

SHCOMP,

as European markets marched higher SXXP,

UKX,

DAX,

PX1,

The graph

Map of Marshall Gittler at BDSwiss.

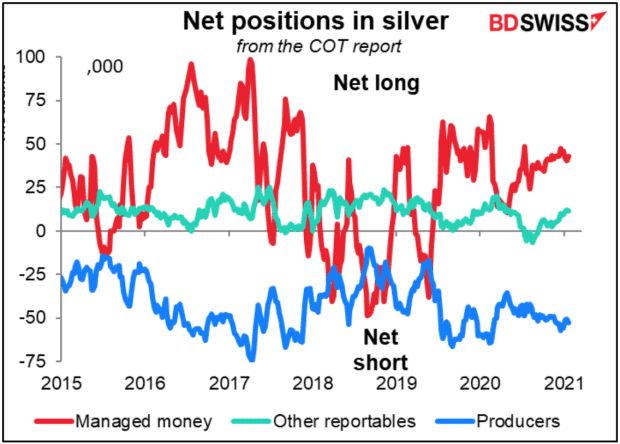

Our chart of the day, from Marshall Gittler at BDSwiss, shows who’s going to be short on silver – and he doesn’t really know who WallStreetBets is targeting. It is the silver producers who are shorting the futures market, the analyst said, but it is normal for them to go short because they are selling their production ahead to lock in prices.

Random reads

Naked mole rats have unique dialects and are “incredibly xenophobic,” according to one study.

Research shows that singing in some languages can spread the coronavirus that causes COVID-19 more easily than others.

Need to Know starts early and updates to the opening bell, however Register here to get it in your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing, including exclusive commentary from Barron’s and MarketWatch writers.