Yields on U.S. Treasuries surged Wednesday after the early vote indicated Democrats were on track to win both Senate seats in Georgia and thereby control Congress, an outcome that would give the Biden administration more leeway to pursue its policy agenda. .

What do Treasurys do?

The 10-year Treasury earns TMUBMUSD10Y,

was at its March high of 1.041%, 8.6 basis points higher than the previous day. The 2-year interest rate TMUBMUSD02Y,

fell 2.2 basis points to 0.143%, while the 30-year bond yield TMUBMUSD30Y,

climbed 11.4 basis points to 1.819%, more than an eight-month high.

What drives Treasurys?

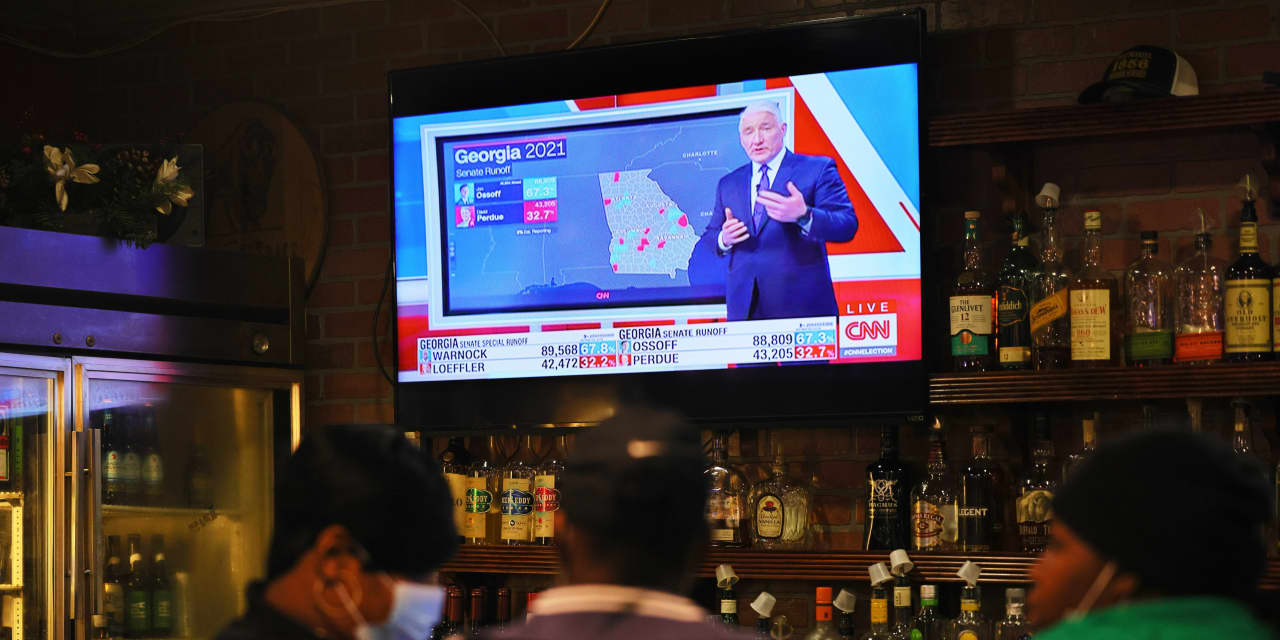

Preliminary voting results show that Raphael Warnock won one of two Senate rounds in Georgia early Wednesday, according to the Associated Press, bringing Democrats closer to a majority in the Senate.

Also with 98% of the expected votes reported, Democratic challenger Jon Ossoff led Republican Senator David Perdue by just 0.4 percentage points.

With Senate control in sight, Democratic lawmakers may have more leeway to enact more aggressive tax measures that could weigh on the bond market through increased debt issuance and higher inflation expectations, analysts said.

Indeed, the 10-year bond broke through the key 1% level that the benchmark maturity contained since March.

ReadUS Bond Market Could Face ‘Taper Tantrum’ Risk Following Senate Outflow in Georgia, Says Jefferies

However, the Treasury sell-off slowed later in the session, after violent pro-Trump protesters broke into the Capitol building, halting a joint session of Congress to certify Joe Biden’s presidential victory.

In US economic data, Automatic Data Processing Inc. that private sector employment fell 123,000 in December, the first drop in 8 months, after rising from 304,000 in the previous month. Factory orders were up 1% in November.

The Federal Reserve’s minutes of the December policy meeting showed that only a small fraction of the 17 members of the interest rate committee last month were in favor of expanding long-term Treasury purchases.

What did market parties say?

The projected “spike in spending translates into more back-end supply and higher inflation, hence the steeper curve,” said Kevin Walter, co-head of Treasurys trading at Barclays.