Jerome Powell, chairman of the Federal Reserve, said this week that the central bank “will provide the economy with the support it needs while it lasts.”

That means that low interest rates are likely to continue, putting income-generating investment under pressure.

One way to get ahead is with dividend stocks and the exchange-traded funds they hold. Below is a list of the US ETFs with the highest dividend yields – they range from 4.9% to 9.8%.

Mark Grant, the chief global fixed income strategist at B. Riley Financial, wrote in his March 22 Out of the Box email that, with an inflation rate of 1.68% last month, to any form of “real return,” or you just play mahjong “with inflation and the Federal Reserve.

Since bond yields are prohibitively low, he prefers closed-end funds and exchange-traded funds to achieve that income target. He warned that investors should do their homework to select the right one.

ETFs are easier to analyze than closed-end funds, especially ETFs with diversified portfolios.

Focusing on income, not growth

There is a difference between investing for growth and investing for income. The purpose of an income portfolio is not to beat the total return of a growth index. It is intended for the preservation of income and capital.

The stock market crash in March 2020 serves as an example of holding quality stocks for the long term. No matter how long the recovery takes, if you hold stocks of companies that generate enough cash flow to cover their dividends, you can make money while avoiding volatility.

Dow Inc. DOW,

is an example of this. At the end of 2019, the stock closed at $ 54.73 and the company paid a quarterly dividend of 70 cents a share, for a return of 5.12%. Through March 23, 2020, the stock was down 51% to $ 26.58. The company has not cut the dividend, and its quarterly free cash flow has easily covered the payout since the start of the Covid-19 crisis. And the stock closed at $ 60.75 on March 23, 2021.

Clearly, it was the right choice for Dow shareholders to weather the storm, but many investors lacked the courage. If we take this idea further, the return on Dow’s stock had risen to 10.5% by the end of that dark day of March 23, 2020. The market had allowed patient investors to earn very high returns.

This is all true for dividend stock ETFs, especially high yield ETFs.

Highest yielding ETFs with dividend stocks

A query of FactSet data yielded a list of 66 US ETFs that “weigh stocks by dividends and / or pursue high dividend yields.”

An advantage of ETFs is that they are easy to trade. You can buy or sell anytime when the stock market is open. With open-end mutual funds, you can only sell your shares back to the fund company once a day at the close of the market.

The share price of an open-end mutual fund is its net asset value (NAV), which is the sum of the market values of its assets divided by the number of shares. It is the book value of a fund.

ETFs also have NAVs, as well as their own stock prices that deviate from NAV. Grant wrote that when analyzing closed-end funds and ETFs, he says “no thank you” when the stock price is above NAV. But while some closed-end funds can trade at high premiums to NAV, most dividend stock ETFs listed here trade for small premiums or discounts.

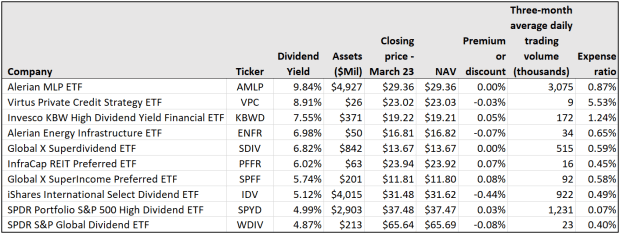

Here are the 10 US dividend stock ETFs with the highest dividend yields on March 23:

(FactSet)

You can see that the premiums for NAV, if any, are small.

These ETFs take different approaches and you should go to the managers’ websites to read about the objectives and management styles of everyone you consider. Some are narrowly targeted, which can increase risk.

The table contains the average daily trading volume over three months. The bigger your holdings, the more important liquidity becomes when you’re trying to buy or sell at the best price on any given day. The second highest yielding ETF on the list, Virtus Private Credit Strategy ETF VPC,

has an average daily trading volume of just 9,000 shares. This means that the trades of each individual investor have a gross effect on that day’s price flow.

Use limit orders for your trades regardless of liquidity. They cost nothing extra and can save you from temporary price disruptions.

The annual expense ratio of that Virtus ETF seems alarmingly high at 5.53%. However, this is another area that investors should take a second look at. The fund invests in business development companies and closed-end funds, which are required to include their own interest expense (as they are used as leverage) as part of their management fee. The annual management fee for the Virtus Private Credit Strategy ETF is 0.75%, and the remainder of that 5.53% expense ratio represents the management fees of the BDCs and closed-end funds it owns.

The Invesco KBW High Dividend Yield Financial ETF KBWD,

has the third highest dividend yield on the list and the second highest expense ratio of 1.24%.

However, FactSet has this to say: “The fund’s staggering fee is a regulatory illusion. It is required to report the operating expenses of its private equity interests as part of its expense ratio. Real holding costs were consistently in line with KBWD’s very reasonable management fee ”of 0.35%. The ETF focuses on both real estate investment funds and private equity funds.

The largest ETF on the list is the Alerian MLP ETF AMLP,

that invests in energy partnerships that typically yield a high dividend yield, but also complicate investor tax returns. The ETF avoids the tax complication. But space was extremely volatile. AMLP’s stock price has suffered for some time. So far, shares are up 14% in 2021.

The listed ETF with the second highest trading volume was the SPDR Portfolio S&P 500 High Dividend ETF SPYD,

It follows what FactSet calls “a no-nonsense approach to high yield in the US large-cap market.” SPYD takes equally weighted positions in the 80 stocks of the S&P 500 with the highest dividend yields. It rebalances monthly and has the lowest cost of any ETF on the list. The 4.99% return is comparable to a 1.48% dividend yield for the entire S&P 500.

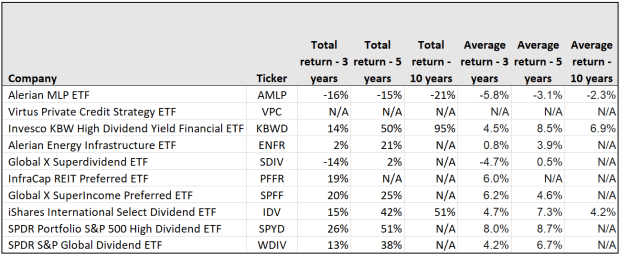

While it is important to reiterate that income is the primary objective here, total return (with dividends reinvested) can provide useful comparisons of long-term performance.

Here are the total returns and average annual returns for the group for three, five and 10 years.

(FactSet)

The SPDR Portfolio S&P 500 High Dividend ETF has delivered the best returns over three and five years, while the Invesco KBW High Dividend Yield Financial ETF wins the award out of three that have been around for 10 years.